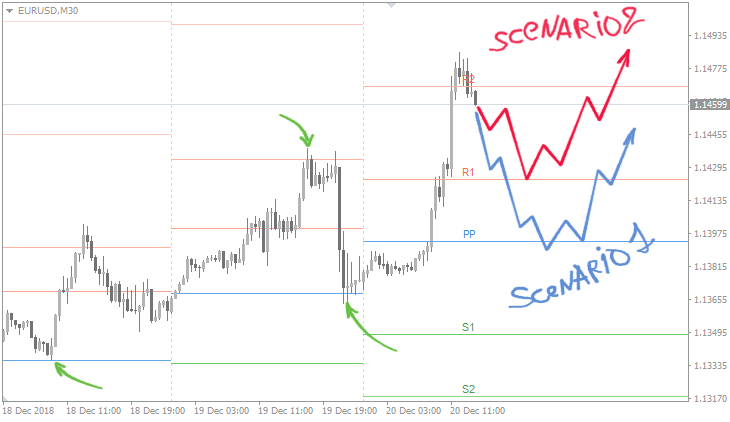

There are various types of pivot analysis. For instance, a trader can set a stop-loss close to any of the recognized support or resistance levels. The pivot point also helps the trader in determining when to enter or exit the market. A bearish market exists when price action stays or drops beneath the pivot level.Ĭonversely, a mulish market exists when the price action stays or crosses over the pivot level. Traders make use of pivot points in deciding market trends, based on the price action direction. Pivot points have many applications, amongst which are: 1. A set calculation is used in forming pivot points. Pivot points are a form of forex indicators used for technical analysis, which presents the foundation for establishing market trends. Pivot points stand for the averages for the highs, lows, and closing prices that take place inside a trading session or a trading day.Ī pivot point can also be seen as an area of possible support or resistance where price may ‘pivot’ or alter its course. It helps the trader in deciding the movement of prices in the financial markets. What is a pivot point?Ī pivot point is a price level that a professional trader uses to evaluate whether market prices are bullish or bearish.

#INSTALL PIVOT POINTS FOR MT4 ON MAC HOW TO#

This post will show you what a pivot point is, how to calculate pivot points, and how to install the indicator.

With this indicator, it is easy to read price movements to be able to plan the right strategy for trading. Therefore, one of those highly helpful tools is the MT4 Pivot Point Indicator. You may not be a professional in understanding price movements, but with some fantastic indicators, you can easily read the market even if you are not tech-savvy. Otherwise, using the wrong knowledge to enter a trade could be the easiest way to lose your hard-earned money. Welcome again to the best mt4 indicators website! Every forex trader that wants to make a profit from the market should be able to determine when the market is bullish or bearish.

0 kommentar(er)

0 kommentar(er)